Prestige Car Protection

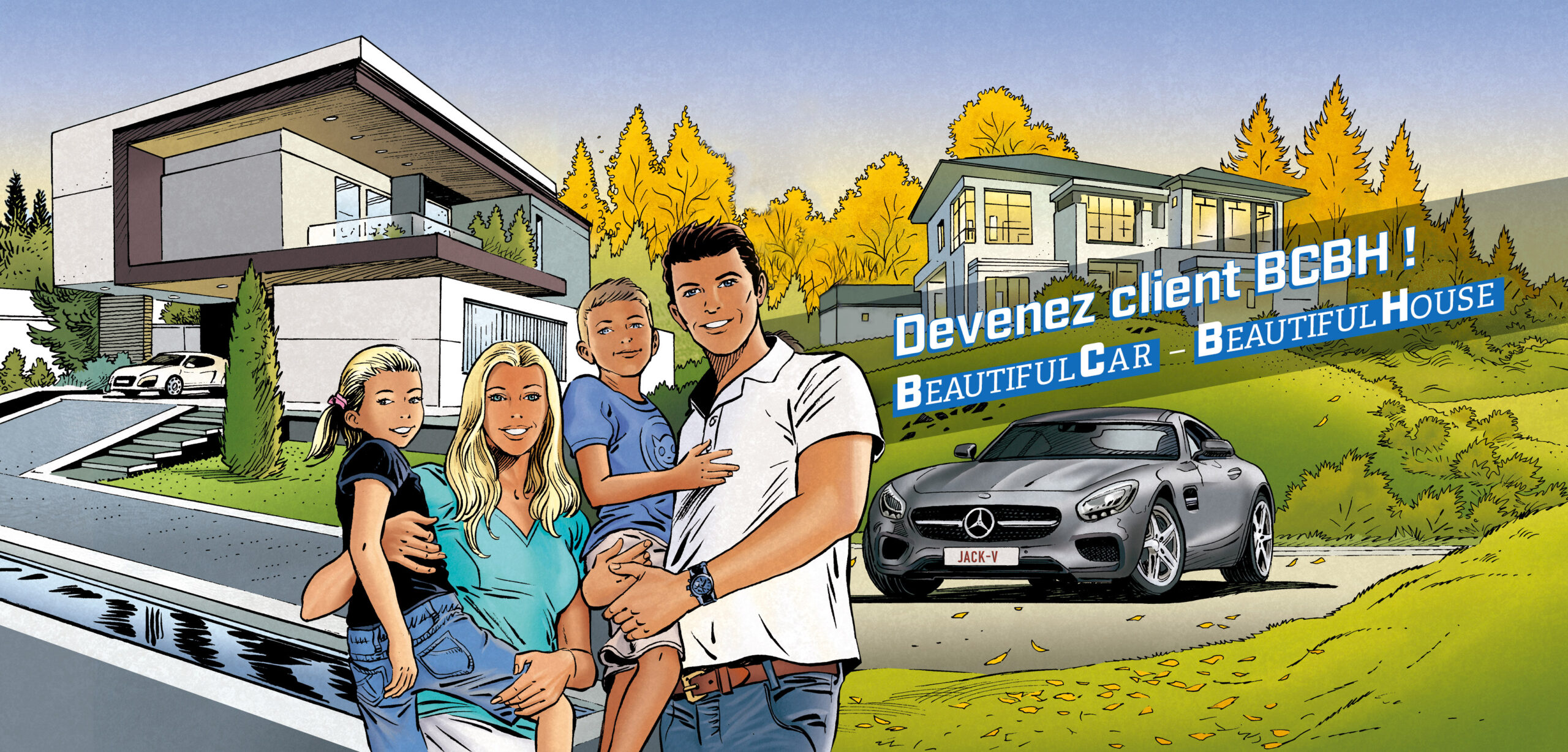

Devenez client BCBH !

Profitez de notre action « Beautiful Car – Beautiful House » et bénéficiez d’une réduction complémentaire sur les primes de vos couvertures « Prestige Car Protection » ET « Prestige Home Protection » !

Une assurance sur mesure pour votre voiture de prestige. Coupé sportif, cabriolet raffiné, limousine ou SUV de grand luxe, cette assurance couvre les véhicules récents issus des prestigieuses marques automobiles.

Quels sont les véhicules concernés ?

Prestige Car & SUV : Tous les véhicules prestigieux ou exclusifs d’une valeur à neuf égale ou supérieure à 75.000 € HTVA. Tous les modèles Porsche sont acceptés. Ces véhicules doivent avoir moins de 5 ans d’âge au moment de la souscription (les véhicules des marques Ferrari, Aston Martin, Bentley, Lamborghini, Rolls- Royce et Porsche sont acceptés jusqu’à 10 ans d’âge).

Quelle est la valeur assurée ?

- Pour les véhicules neufs : la valeur à neuf hors TVA et hors remise, options et accessoires compris

- Pour les véhicules de seconde main : la valeur réelle fixée par un expert.

Quelles sont les garanties proposées ?

- Risque Statique :

- Incendie, vol et vandalisme avec effraction dans le garage, forces de la nature, dégâts des eaux. Les couvertures sont uniquement acquises dans le garage dont l’adresse est reprise au contrat. Cette solution est destinée aux véhicules qui ne sont pas immatriculés.

- Omnium partielle :

- Incendie, vol, vandalisme avec effraction dans le garage, forces de la nature, dégâts des eaux, bris de vitrage, heurts d’animaux et gibier.

- Assistance complète

- Omnium Complète :

- Dégâts matériels, vol, incendie, dégâts des eaux, bris de vitrage, forces de la nature, vandalisme, heurts d’animaux et gibier.

- Assistance complète

Quelle dégressivité s’applique dans le cadre de cette couverture ?

En cas de perte totale, de vol ou tentative de vol, aucune dégressivité ne sera appliquée durant les 24 premiers mois suivant la date de première mise en circulation du véhicule ou 12 mois suivant la date d’expertise du véhicule assuré. à partir du 25ème mois (ou 13ème mois pour les véhicules expertisés), une dégressivité de 1% par mois sera appliquée. L’assuré a toujours la possibilité de faire expertiser à nouveau son véhicule quand il le souhaite.

À qui s’adresse cette couverture ?

Cette garantie s’adresse aux conducteurs de minimum 30 ans et de maximum 70 ans.

Quelles sont les garanties additionnelles qui peuvent être ajoutées à la couverture omnium (uniquement pour véhicule immatriculé en Belgique) ?

- Responsabilité Civile (sous réserve d’acceptation par la compagnie)

- Protection Juridique

- Individuelle Conducteur

Quelles sont les franchises d’application dans le cadre de cette garantie ?

- Dégâts matériels pour le(s) conducteur(s) repris au contrat (sous réserve de la statistique sinistre) :

- Franchise de 1,00 % de la valeur assurée avec un minimum de 750 € et un maximum de 2.000 €

- Dégâts matériels pour tout autre conducteur non repris au contrat :

- 1,50 % pour les conducteurs de plus de 30 ans*

- 3,00 % pour les conducteurs de moins de 30 ans*

- 6,00 % pour les conducteurs de moins de 25 ans*

- Pas de couverture pour les conducteurs de moins de 21 ans.*avec un minimum = 1.250,00 €

- Vandalisme : 500,00 €

- Autres garanties : Pas de franchise

Quelles sont les protections ou mécanisme à installer contre le vol ?

- Pour la plupart des véhicules : système d’origine (VV2 + anti-soulèvement) ;

- Pour les marques allemandes : VV2, anti-soulèvement et TT3 ou TT4.

- Pour les véhicules du marque Range Rover : VV2, antisoulèvement et TT4.

Quels sont les documents à fournir pour pouvoir souscrire cette couverture ?

- Une proposition complétée et signée par le preneur d’assurance

- La facture d’achat du véhicule ou une expertise du véhicule + photos

- La copie du permis de conduire du ou des conducteurs

- Une attestation du système d’alarme et/ou du système antivol

- Une attestation de sinistralité sur 5 ans.