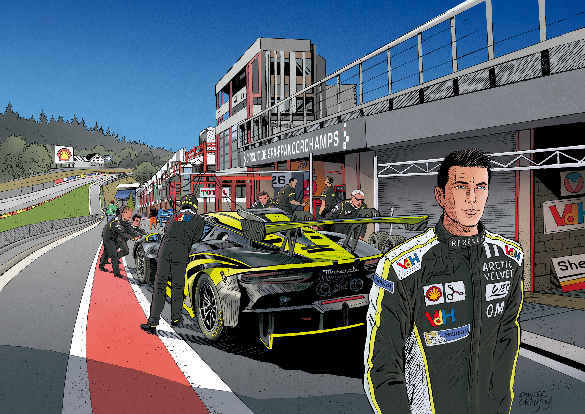

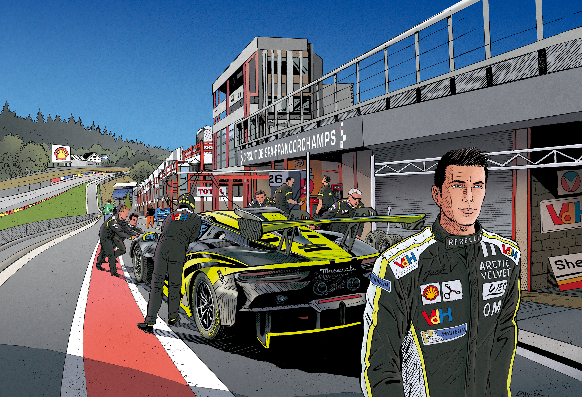

Racing Solutions

Racing Solutions

L’assurance haut de gamme conçue pour protéger vos véhicules de compétition.Racing Solutions

L’assurance haut de gamme conçue pour protéger vos véhicules de compétition. Que vous participiez à des courses d’endurance, à des épreuves de monoplaces ou à des championnats GT, Racing Solutions offre une couverture exclusive adaptée aux exigences du sport automobile.

Avec des garanties spécifiques aux courses officielles, aux essais privés et au stockage sécurisé, cette assurance sur mesure s’adresse aux pilotes et équipes engagées en compétition. Pensée pour les machines d’exception, elle combine protection optimale et flexibilité, afin que vous puissiez vous concentrer sur la performance.

Quels sont les véhicules concernés ?

Tous les véhicules de compétition, qu’il s’agisse de prototypes d’endurance, monoplaces, GT ou autres véhicules spécifiquement conçus pour le sport automobile. Ces véhicules doivent être inscrits à des événements couverts et respecter les conditions de souscription, notamment un contrôle préalable par un expert si requis.

Quelle est la valeur assurée ?

Une valeur en premier risque toutes taxes comprises.

Quels sont les avantages de ce produit ?

- Une couverture incluant les dommages matériels et l’incendie en premier risque.

- Un capital saison permettant une indemnisation multiple jusqu’à épuisement du montant souscrit.

- Une garantie spécifique pour les essais privés et officiels.

Quelles sont les garanties proposées ?

- Omnium Course : Couverture des dégâts matériels, incendie lors d’événements officiels.

- Risque Statique : Incendie et vol lorsque le véhicule est stationné dans un garage sécurisé repris dans le contrat.

- Individuelle Pilote : Couverture en cas d’accident avec indemnisation en cas de décès, invalidité ou incapacité temporaire.

- Team : Le camion et/ou la remorque de course ainsi que le matériel de course.

Quelles sont les franchises appliquées ?

Une franchise sera calculée selon le profil du conducteur et la catégorie du véhicule.

Documents nécessaires pour souscrire une assurance Racing Solutions

- Les informations complètes concernant le(s) pilote(s) et/ou le(s) team(s).

- Proposition d’assurance complétée et signée.

- Reportage photo préalable du véhicule (vitrage, structure, châssis).

- Confirmation du paiement de la prime au plus tard la veille du premier événement couvert.

- Éventuelle expertise, si exigée.